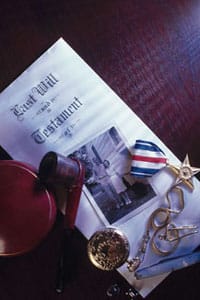

Estate Planning

Whether your assets are substantial or few, every person and family can benefit from solid estate planning.

Young, healthy people can leave behind a spouse and children. There is no direction for the assets or care of the spouse and children if that person did not have a will. Some assets may go to the spouse, while others may go to the benefit of surviving children. The funds may be subject to the jurisdiction of the Surrogate’s Court. The children could get their money – all of it, in a lump, with no strings – on their 18th birthdays.

There is so much that can be done to protect your family with good estate planning. It may even be possible, when appropriate, to avoid probate court entirely.

It is possible to register your will with the State of New Jersey Secretary of State. To learn about online will registration, go to New Jersey Online Will Registry.

Email Ms. Armstrong to make an appointment to discuss your estate planning needs.

What You Should Be Prepared To Bring To Your Appointment

|

Proper planning can make life easier for you and your family.

Contact us today to make an appointment or call 888-371-4158 to get started today.